Let’s be honest: insurance is complicated.

Or should we say: it is misunderstood. And simply because of that some people to prefer to avoid it completely.

Don’t make the same mistake: no-one in China is totally safe from scooters crash, sports injuries, or appendixes burst, and a good health insurance plan is the best way to protect yourself.

That’s why, we came up with this guide: after those 4 steps, you should be able to better understand insurance and be ready to select one for yourself.

Step1 – Determine your budget and your priorities

This is the first range of questions I usually ask to people who approached me.

-Your budget is crucial to determine how comprehensive your medical coverage will be: obviously, the more money you are ready to put in, the more comprehensive the coverage would be.

-But don’t worry: there are also some attractive options for limited budgets, we’ll see that later in this Guide.

-Your coverage should also match your priorities and your needs, for example if you regularly do sport, you should find a coverage that would protect you in case of sports injury.

Step 2 – Understand the different benefits

In-patient, Dental, Maternity, Optical… There is so many benefits you could apply for that it makes it hard to choose – unless you are already experienced in getting covered of course.

That is why, if you are young and/or healthy I recommend you to go for In-Patient first, which will cover some of the most expensive and inconvenient injuries or diseases.

Below find out the different benefits and their order of priorities, with In-Patient being your first priority:

It is especially true if your budget is limited: having to pay in-patient treatment by yourself would be almost impossible – count several hundred thousand yuan for an operation.

On the contrary, coverage on in-patient treatments are usually affordable to many people: it could start at 7000 RMB a year for limited coverage.

Step 3 – Choose an area of coverage

Mainland China or Greater China? Worldwide Including or Excluding USA?

There are many options when it comes to the area you want to be covered, and, again, it falls down to your priorities. Obviously, the larger the area, the higher the cost of your coverage.

« Should I choose a ‘Worldwide’ coverage, or simply for ‘Mainland China’? »

Because of this year’s Covid-19, I have been asked this question quite a lot of times. My recommendation: if your plan is to stay in China for the upcoming years, then a coverage ‘Mainland China’ is enough. But know that you won’t be covered if you ventured outside of China (you will need a travel insurance for that)

Step 4 – Have a look at your insurer network

If you want to go to a specific hospital or one particular doctor, make sure that they have an agreement with the insurer you are about to buy from.

I particularly recommend that to people:

-willing to go to a hospital they trust in case of emergency (don’t forget to bring your insurance card with you)

-having a condition and willing to continue to consult with the same doctor,

-for parents who wants to consult a specific doctor they are comfortable with for their children.

How to check? Just ask your insurance, the hospital, or your broker: they will inform you easily. If your plan offers direct-billing, be sure to check that too.

In short:

Of course, those are just beginner’s advice and there are many other things you should know about insurance.

-You can make it more convenient with Direct-Billing

-You can make it more affordable with co-payment or deductibles.

Following those 3 easy pieces of advices, you should end with a decent health insurance that gives you peace of mind.

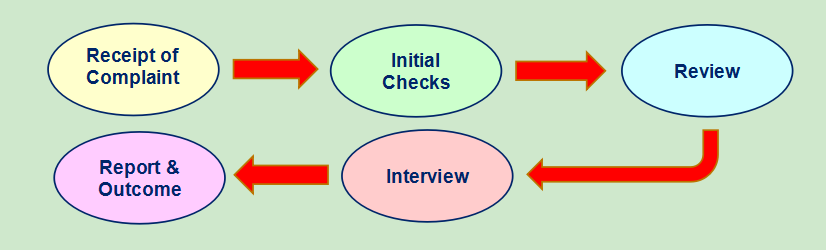

Compliance will work towards providing a final response to the complainant within 20 business days. If the case turns out to be of a nature that is complicated or even complex that requires an extension of time, which is likely to take beyond the 20 business days after receipt of the complaint, Compliance will send a request of extension of time to the relevant party.

Compliance will work towards providing a final response to the complainant within 20 business days. If the case turns out to be of a nature that is complicated or even complex that requires an extension of time, which is likely to take beyond the 20 business days after receipt of the complaint, Compliance will send a request of extension of time to the relevant party.